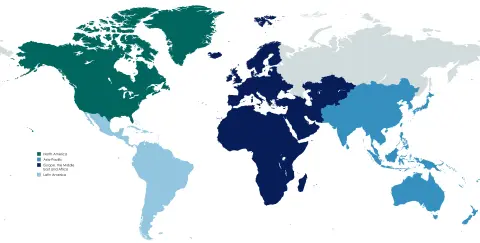

Navigating complex global markets

Global Equities

Our Global Equities division leverages a network of 60+ local and international brokers, providing seamless access and execution across global markets. We offer both low-touch and high-touch trading solutions, including program trading, with real-time support in all major financial centers through our “follow the sun” coverage model. Operating under an Agency-Only model, we deliver unconflicted execution, specializing in small and mid-cap securities and sourcing diverse liquidity pools for Best Execution.